Forex Trading Rules – Lot, Leverage and Profit-Loss!

As a trader, you need to have a clear understanding of lots, leverage, profit, and loss issues.

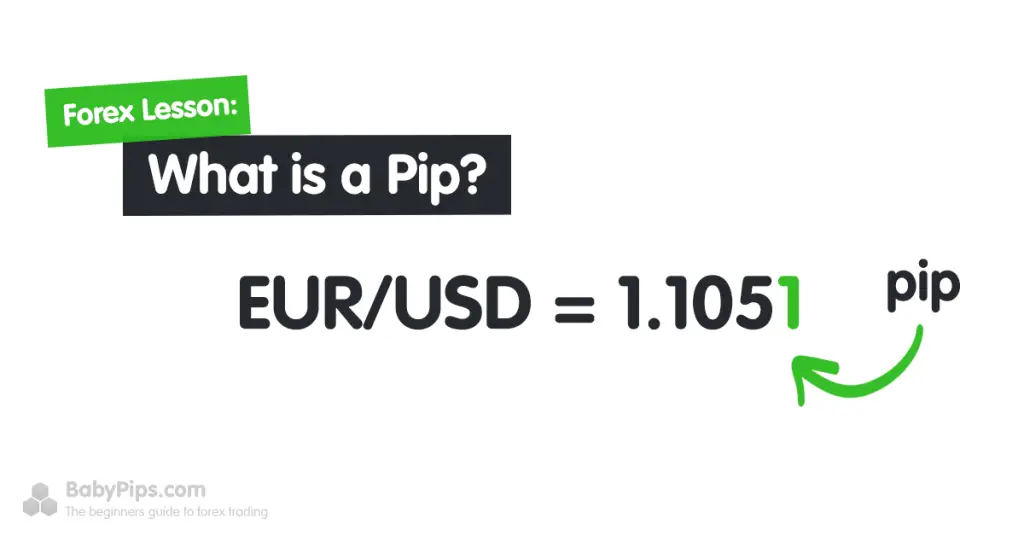

What is Pip?

Usually one unit change or movement per 4th digit after decimal of currency pair is called PIP or Pip. Pips more than 1 are called pips. 1 pip = 0.0001 and 2 pips = 0.0002. For example if EUR/USD value goes from 1.15000 to 1.15100 then it is counted as 10 pips.

However, there is some difference in the calculation of pips in Japanese pairs because Japanese pairs are calculated in 2 decimal places. Pips are calculated to the last decimal in this field. Suppose if USD/JPY goes from 110.10 to 110.20 then it will be considered 10 pips. Currency quotations are also 5 digits instead of 4 digits, they are called fractional pips or pipettes. Usually ECN or STP brokers have 5 digit price feed.

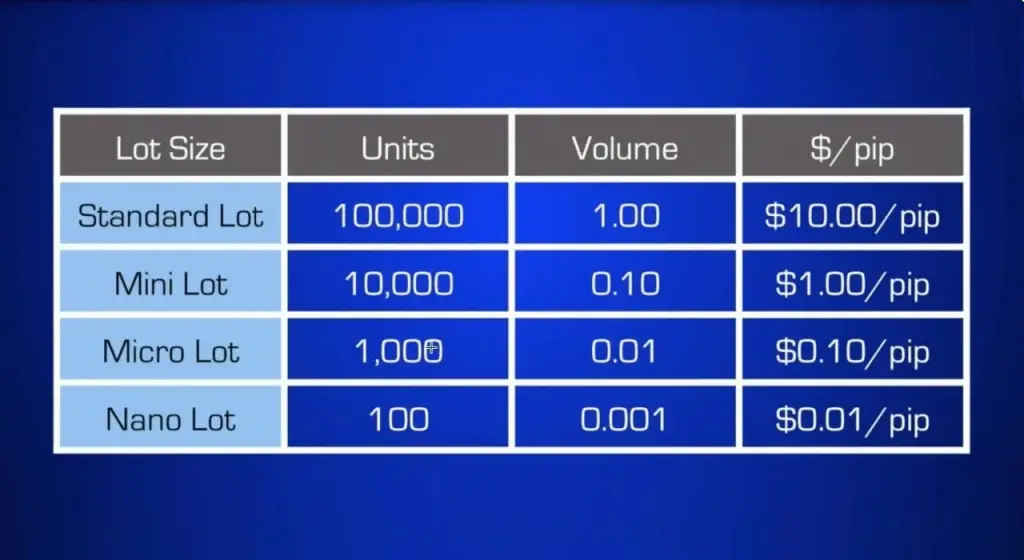

Calculating the lot:

- Standard Lot Broker

- Mini Lot Broker

- Micro Lot Broker

1 lot = $10/pips in standard lot broker. But in mini lot broker 1 lot = $1/pips. And in micro lot broker 10 lots = $1/pips. That means, if you open a trade with 1 lot in a standard lot broker and 10 pips go in your favor, your profit will be $10×10=$100. A corresponding loss would be $100.

But, if you open a trade with 1 lot in mini lot broker and 10 pips go in your favor, your profit will be $1×10=$10. Similarly the loss will be $10. And, if you open a trade with 1 lot on micro lot broker and 10 pips go in your favor, your profit will be $0.1×10=$1. A corresponding loss would be $1.

Standard Lot Broker:

- 1 standard lot = $10/pips

- 0.1 standard lot = $1/pips

- 0.01 standard lot = $0.10/pips

- 10 standard lots = $100/pips

Mini Lot Broker:

- 1 mini lot = $1/pips

- 0.1 mini lot = $0.10/pips

- 0.01 mini lot = $0.01/pips

- 10 mini lots = $10/pips

Micro Lot Broker:

- 1 micro lot = $0.10/pips

- 0.1 micro lot = $0.01/pips

- 0.01 micro lot = $0.001/pips

- 10 micro lots = $1/pips

Most brokers will let you trade as low as 0.01 lot. That is, the minimum pip value you can take with a standard lot broker is 10 cents. But in mini lot broker you can take minimum pip value of 1 cent. And in micro lot broker you can take minimum pip value of 0.1 cents. So if your capital is less, then you can trade with mini lot or micro lot broker with less risk. Not only that you can trade in 1 lot, 0.1 lot or 0.01 lot, you can also trade in custom lots like 2.5 lots, 1.3 lots if you want.

How to understand my broker micro lot, mini lot or standard lot?

When you go to open an account with the broker, you will get details such as: account type, minimum deposit, spread, leverage, etc. Also, if you do not know whether your broker is micro lot, mini lot or standard lot, then ask the broker’s live support. Sometimes it is also given on their website. Or open a demo account with them and open a trade with 1 lot. Note here that some brokers have standard lot, mini lot, micro lot according to account type.

Now let’s know the method of lot calculation through units:

- Standard = 100,000 units

- Min = 10,000 units

- Micro = 1,000 units

Suppose we trade with 1 lot i.e. 1,00,000 units. Now let’s see how to calculate the pip value:

When USD is base currency: (0.01/exchange rate) X 100,000= $XX per pip

- (1) USD/JPY exchange rate is 119.800 so (0.01/119.80)*100.000= $8.34 per pip.

- (2) USD/CHF exchange rate is 1.4555 so (.0001/1.4555)*100.000= $6.87 per pip.

When the dollar is not the base currency, the calculation is slightly different:

USD quote currency: (0.01/ exchange rate) X 100,000 X exchange rate = $XX per pip

- (1) EUR/USD exchange rate is 1.1930 so (.0001/1.1930)*100.000= €8.38 X 1.1930= $9.99734 or $10 per pip.

- (2) GBP/USD exchange rate is 1.8040 so (.0001/1.8040)*100,000 = £5.54*1.8040 = $9.99416 or $10 per pip.

It should be noted here that lot calculation methods may be different in different brokers. But no matter how they calculate the pip value, they will help you understand how they calculate the pip value if you ask.

What is leverage?

Leverage is called margin loan in Bengali. Those of us who are associated with the STOCK market are very familiar with the term “margin loan”. So that you can start trading with a small amount of capital, every forex broker provides a loan against your capital and this is called leverage. Now let’s make this more clear with an example:

Suppose your capital is only 50 dollars and if your leverage is 1:500, then the broker will give you a maximum loan of 500 times when you trade. That is why you can trade maximum 50*500=$25000 dollars.

The broker will give you a large amount of money against your small amount so that you can make more profit by trading in the forex market. This is because the broker lends you money to trade and when you close the trade, the broker takes his money back. Let’s see how:

Suppose you have $500. The current price of GBP/USD is 1.5000. You want to buy 1 micro lot (ie $1 per pip). Your preferred leverage is 1:100. This means 10,000 units

Your broker will let you start trading with $150. This $150 you will see as margin in your account. Your broker will return $150 to your account when you close the trade.

One thing must be remembered, just as more leverage will help you make more profits, more leverage can also expose you to more losses. So it is always better to keep leverage limited in trading.

Checkout this article: Rules of Trading – Complete Guide!